Annex "Tourism" (2017)

1. Tourism in the Wadden Sea Region

Tourism is an important economic sector in all three Wadden Sea countries, generating income and job opportunities as well as tax revenue and contributing considerably to the national and local economies. Thus, according to the World Travel and Tourism Council (WTTC), tourism in Denmark generated more than EUR 18 billion in 2015 contributing 6.9% of the country’s GDP and generating about 213,000 direct and indirect full-time jobs. Similarly, WTTC estimates that tourism in Germany generated EUR 258 billion in 2014, contributing 8.9% of the country’s GDP and generating almost five million direct and indirect jobs. For the Netherlands, the WTTC estimates that tourism generated about EUR 36 million, contributing 5.6% to the country’s GDP and generating about 709,000 direct and indirect jobs.

Also in the Wadden Sea region, tourism and recreation play a substantial role and contribute heavily to the local economy in respect of local income and employment generation as well as generation of tax revenue to the local authorities. Thus, it is estimated that tourism and recreation generate almost EUR 7 billion and create about 58,000 full-time job opportunities.

The importance of tourism for the overall Wadden Sea region and the three individual regions has steadily increased since the QSR 2004 and QSR 2009, as will be shown later in the chapter, and as summarised in Section 5.

Furthermore, the World Heritage status accorded to the Dutch and German parts of the Wadden Sea in 2009, which was extended to the Danish part in 2014, will undoubtedly have a positive impact on tourism development in the regions, both in respect of increasing visitor numbers and in respect of tourism revenue. This is an issue that will need further investigation in the future.

1.1. Geographical Area

For the purpose of the Quality Status Report 2016, the geographical area of measurement for tourism refer to the Wadden Sea World Heritage Destination (as defined in Table 3, and on page 4 of the WH Sustainable Tourism Strategy) as outlined in Figure 1 below (same area as for the QSR 2004 and 2009).

Figure 1. The Wadden Sea World Heritage Destination (World Heritage Tourism Strategy). For this report, the counties of Stade in Lower Saxony and Pinneberg and Steinburg in Schleswig-Holstein are not included because they are not bordering the Wadden Sea coast.

Figure 1. The Wadden Sea World Heritage Destination (World Heritage Tourism Strategy). For this report, the counties of Stade in Lower Saxony and Pinneberg and Steinburg in Schleswig-Holstein are not included because they are not bordering the Wadden Sea coast.

The Danish Wadden Sea region is defined as the four municipalities: Varde, Esbjerg, Fanø, and Tønder, also comprising of Destination Southwest Jutland.

The German Wadden Sea region covers the Lower Saxony Wadden Sea region (counties of Leer, Aurich, Wittmund, Friesland, Wesermarsch and Cuxhaven, including the seven islands of Wangerooge, Spiekeroog, Langeoog, Baltrum, Norderney, Juist, Borkum, and the three cities of Emden, Wilhelmshaven and Bremerhaven), Hamburg (island of Neuwerk) and the Schleswig-Holstein Wadden Sea region (Nordfriesland and Dithmarschen counties including the islands of Sylt, Pellworm, Amrum, Föhr and 10 Halligen).

The Dutch part of the Wadden Sea region consists of two provinces: Friesland and Groningen, and part of Noord-Holland (Hollands Kron, Den Helder, Texel).

1.2. Collection of Tourism Statistics in the Wadden Sea World Heritage Destination

Collecting and measuring tourism data for the Wadden Sea World Heritage area is a challenging task. Due to the different administrative regulations and laws in the three neighbouring countries, transnational statistics on tourism, even for basic figures like the number of overnights, lack a common, uniform data basis. Although Eurostat has developed a Methodological manual for tourism statistics, it only forms a framework for the individual national statistics offices (NSOs) and leaves them with some degree of flexibility in setting up national systems of tourism statistics.

For instance, the Eurostat guidelines (European Commission: Regulation (EU) No 692/2011 of 6 July 2011 concerning European statistics) stipulates that the scope of observation for ‘hotels and similar accommodation’ and for ‘holiday and other short-stay accommodation’ shall at least include all tourist accommodation establishments having 10 or more bed places. However, while the German national statistics authorities collect information on a regular basis of overnight stays from all esteblishments with 10 bed places or more, the Danish National Statistics Office in the regular statistics only includes accommodation establishments with at least 40 bed spaces. Smaller establishments are only included in a sample survey every 4th year.

The main differences are outlined in the following, and for the sake of comparison, one needs to accept the differences and occasionally, only estimations can be provided. Subsequently, we recommend further standardisation of the statistics in line with the United Nations World Tourism Organisation (UNWTO) between the three and other EU member countries.

In Denmark, the Danish National Statistical Office, Danmarks Statistik in compiling tourism accommodation statistics does not cover accommodation establishments with less than 40 bed spaces. Similarly, only camping sites with at least 75 units are included in the statistics. Finally, for holiday homes, only units being rented through commercial renting companies, which are members of the national association of holiday homes (Feriehusudlejernes Brancheforening).

While data for the utilisation of hotel, camping, youth hostel and marine accommodation are released monthly, data for use of holiday homes are only released quarterly.

In Germany, official tourism statistics published by the statistical authorities in the regions do not cover establishments with less than 10 beds. However, in rurally structured regions like in parts of the North Sea coast of Schleswig-Holstein and Lower Saxony, the percentage of vacation accommodations rented out by smaller operations can be up to 80%. These belong to the so-called “grey accommodations market” and are not accounted for in the official statistics.

For Schleswig-Holstein, the Statistikamt Nord, which is also covering data for the city of Hamburg, is collecting the official statistical data, in Lower Saxony the Landesamt für Statistik is the statistical authority, which provides the data.

Tourism surveys like the Kapazitätsmonitor Tourismus Schleswig-Holstein, estimate that in 2013 there were about 35,000 beds offered by establishments with less than 10 beds. Therefore, the official statistics lack more than 30% of the total bed capacity available in the Schleswig-Holstein part of the Wadden Sea region. Mehrwert plus (Hrsg. Nordsee-Tourismus-Service GmbH 2014) gives an estimate of 18.7 million overnights including the grey market, more than twice as much compared to the official statistics (8.4 million in 2013).

For Lower Saxony more detailed statistics of local bodies like municipalities and Kurverwaltungen, which also covers establishments with less than 10 beds, show significant differences between the official statistics and real demand. On the seven East Friesian islands for example, the official statistics for 2014 stated that there were about 845,000 guest arrivals and 5.1 million overnights during the year. However, unofficial and more extensive statistics by the Kurverwaltungen estimated 1.4 million arrivals and 10.3 million overnights. The substantial gap between official statistics and more realistic research estimates may also apply to other destinations in mainland Lower Saxony.

In Germany, the somehow unsatisfying availability of suitable data on the tourism in protected areas and their regional economic effects lead to the development of a tailored methodology to calculate the specific regional economic effects of tourism in protected areas. It combines available public data with on-site interviews. The methodology provides an alternative to the official tourism statistics and has been applied in numerous protected areas including the Wadden Sea National Parks in Lower Saxony and Schleswig-Holstein. An overview on the results was recently published by the Bundesamt für Naturschutz as BfN-Skripten 431(BfN 2016) (http://www.bfn.de/fileadmin/BfN/service/Dokumente/skripten/Skript_431.pdf )

The most important advantages of these data include:

- They refer directly to the protected areas and not only to the administrative area in which the protected area is located, and

- They also cover the “grey accommodation market” as they are not restricted to the commercial establishments with more than 9 beds.

However, the figures are not comparable to the statistics provided in the previous QSR Reports and that the methodology has so far only been applied in Germany. This is the reason why this report still displays the official statistics rather than the figures revealed by the new studies.

In the Netherlands, the formal tourism statistics is collected and compiled by Statistics Netherlands (Centraal Bureau voor de Statistiek – CBS). Although the Dutch Wadden Sea islands are treated as a separate statistical region, the official statistics are too general to draw conclusions on tourism development in the Dutch Wadden Sea region. Thus, comparable data for the mainland of the Dutch Wadden Sea region are often lacking or are incorporated in general data concerning the provinces as a whole. From 2005 until 2012, the ‘Tour Data Noord’ project of Stenden University provided more detailed data on tourism development in the provinces Friesland and Groningen, also taking into account the islands. Due to a lack of funding, the project stopped in 2013. Most of the data in this chapter are based on the annual reports of Tour Data Noord, supplemented by data in specific reports on tourism development on the islands and in the province of Noord-Holland (Provincie Noord-Holland, 2014). Further, CBS-data were used to describe general trends.

2. Characteristics and Organisation of Tourism in the Wadden Sea Region

This section briefly outlines the characteristics of the existing tourism in the Wadden Sea region within Denmark, Germany and the Netherlands.

2.1. Special Characteristics of Tourism in each Area

2.1.1. Denmark

Tourism in the Danish Wadden Sea is, like in the German and Dutch regions dominated by holiday tourism, and the most common type of accommodation is rented holiday homes followed by camping, while overnights in hotels are only important in the urban municipality of Esbjerg.

Denmark and Germany are by far the two largest markets for the Wadden Sea with German visitors accounting for 62% of the total overnights while Danish overnights account for 31.5%. Other markets are The Netherlands, Norway and Sweden, however each market only accounting for between 1-2% of the total overnight stays. Danish tourists account for almost half of the total tourism revenue.

2.1.2. Germany

According to the 2015 Reiseanalyse , the German Wadden Sea region is the second most popular holiday destination amongst German travellers within their own country. In 2014, 13% of all domestic holiday trips by the German population, lasting five days or more, had a destination in the region. Additionally, the North Sea coast is a popular destination for short holidays and day trips. International inbound tourism is of limited importance for the overall tourism demand, foreign tourists accounting for less than 4% of all overnight stays in the region, except for single destinations like the island of Sylt. In Lower Saxony, but even more in Schleswig-Holstein, tourism is a major economic pillar for those rural, coastal regions.

The unique landscape of the World Heritage destination Wadden Sea attracts travellers from all social and demographic groups in Germany. A main travel motive for actual and potential holiday guests in the German Wadden Sea region is nature. According to the2015 Reiseanalyse ³, guests are exceptionally aware of the natural beauty of the region and appreciate it. Amongst potential guests to the North Sea region in Germany, more than 2 out of 3 (68%) stated in 2015, that “enjoying nature (beautiful scenery, clean air, clean water)” is a very important travel motive, much more than the 54% in the overall population. Same applies for other nature-related motives like “healthy climate” (56%) or “escape from pollution” (28%). According to the guest survey conducted by PROWAD in the German Wadden Sea in 2013, about 20% of all guests refer to the UNESCO World Heritage site Wadden Sea as a main decision factor for their visit to the area.

2.1.3. The Netherlands

The existing pattern of tourism in the Dutch Wadden Sea region is short stays from a weekend to a full week, mainly in rented holiday homes, hotels or camping sites (Stichting Recreatie, as cited in Revier, 2013).

Overall, 58% of the Dutch people have visited at least one of the Dutch Wadden Sea islands, 51% for a short holiday and 35% for a longer holiday. Hiking, cycling, observing nature and swimming are the most popular activities during a holiday in the Dutch Wadden Sea islands (Huig & de Haas, 2009; Sijtsma et al., 2012).

While foreign visitors, primarily Germans, account for more than 30% of the total visitors to Texel and Ameland, the great majority of visitors to the islands are domestic.

Compared with the islands, tourism at the Dutch mainland Wadden Sea region (the Northern part of Noord-Holland, Friesland and Groningen), is far less developed. Tourism development in and around the ferry ports of Den Helder, Harlingen, Holwerd and Lauwersoog hardly benefits from visitor streams to the Wadden Sea islands. Surveys conducted by students of Stenden University reveal that most visitors to the islands are single-destination visitor with limited movements among the island and limited interest in the mainland (Revier, 2013).

2.1.4. Overall Wadden Sea Region

Overall, tourism in the Wadden Sea region as a whole is characterized by holiday tourism, and while the Dutch and particularly the German Wadden Sea regions are dominated by domestic tourists, foreign tourists and especially German tourists are in great majority in the Danish Wadden Sea region. However, there are considerable local differences such as the Dutch islands of Texel and Ameland, attracting a more general public, and the German island of Sylt and the Dutch island of Vlieland, both popular among the jet set. Tourism on the mainland coast of the Dutch Wadden Sea region is far less well developed compared with the German coastal region.

2.2. Organisation of Tourism in each Area

2.2.1.Denmark

The Destination South West Jutland was established in 2008 to undertake tourism development in the four municipalities of Varde, Esbjerg, Fanø, and Tønder, matching the defined area of the Danish Wadden Sea. The main objective is to further the development of year round tourism and the experience economy in the Destination.

It consists of the four municipalities and the local tourism organisations (LTOs) within the municipalities, together constituting the Board of Directors, while a secretariat is lodged with the development and marketing of tourism in the destination.

The four municipalities are also members of the recently established Westcoast Partnership Organisation under the Danish Coastal and Nature Tourism, established in January 2015.

Further, the Wadden Sea National Park Denmark (in Danish National Park Vadehavet) covers an area of 146,600 ha and is Denmark’s largest national park and cooperates closely with Destination Southwest Jutland and plays a significant role in the destination as the main attraction.

2.2.2. Germany

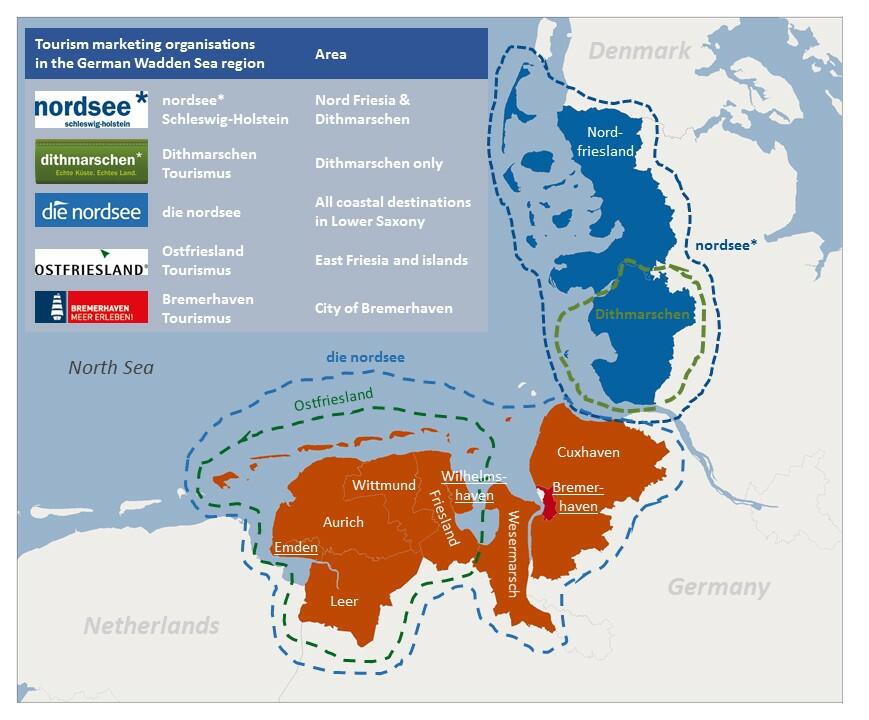

The organisation of tourism in the German Wadden Sea region is quite complex due to its size and various administrative units: Thus, there are the tourism marketing organisations of the three federal states within the region, i.e. Lower Saxony (TMN), Schleswig-Holstein (TASH) and the independent city of Bremen and Bremerhaven (BTZ); not including Hamburg with its very small part of the Wadden Sea, namely the island of Neuwerk. Underneath these federal-level associations, there are a number regional and local tourism organisations (LTOs), including several landkreise and more than 40 municipalities (Fig.2).

Figure 2. Regional tourism marketing organisations in the German Wadden Sea region; Source: NIT 2016.

Figure 2. Regional tourism marketing organisations in the German Wadden Sea region; Source: NIT 2016.

2.2.3. The Netherlands

The organisation of tourism in the Dutch Wadden region is also quite complex. The provincial authorities in Noord-Holland, Friesland and Groningen have the responsibility to develop tourism policy plans for their respective provinces. In addition, the municipalities often formulate their own plans. Destination marketing is also organized on both provincial and local levels. Groningen Marketing and Fryslân Marketing and the tourist boards on the islands (VVV’s) promote their own parts of the Wadden Sea region. The World Heritage status of the Wadden Sea and the trilateral tourism strategy have resulted in more cooperation between all these stakeholders, but a clear and common vision on tourism development and marketing for the whole Dutch Wadden Sea region is still lacking.

3. Volume of Tourism in the Wadden Sea World Heritage Destination

3.1. Capacity and Occupancy of tourist accommodation

Overall, the combined Wadden Sea region recorded almost 53 million overnight stays in 2013 as shown in Table 3 below. The Dutch Wadden Sea region records the largest number of overnight stays with almost 24 million, accounting for 45% of the total, closely followed by the German region recording almost 23 million overnight stays, or 43.3%. The Danish Wadden Sea region recorded 6.2 million overnight stays, accounting for 11.7% % of the total. However, the volumes of recorded overnight stays do not include overnights in smaller accommodation establishment and overnights spent in private accommodation. Arguably, therefore, the volume could be the double as is surveyed in some of the regions.

Domestic tourists account for the bulk of the total number of overnight stays, particularly in the German Wadden Sea region with more than 95%, but also in the Dutch Wadden Sea region with more than 80%. Only in the Danish Wadden Sea region do foreign tourists account for the majority of the overnight stays with about two thirds (68.5%).

Table 3. Tourism volumes in the Wadden Sea Region, latest rounded figures.

The German and the Dutch Wadden Sea regions each records between 4-5 million tourist arrivals in the official statistics, while this figure is not recorded or estimated in Denmark. The figures were in the similar level as in the last QSR 2009 Report (see Table 14 below).

Almost 5,500 commercial accommodation establishments (including hotels, holiday centres, camping sites, etc.) are registered in the entire Wadden Sea Region. Of these, more than 3,500 establishments (with more than 9 bed spaces) are registered in the German Wadden Sea region, accounting for almost 65% of the total, while 1,850 establishments are registered in the Dutch Wadden Sea region, comprising 34% of the total. In contrast, only 76 establishments are recorded in the Danish Wadden Sea region, excluding holiday homes.

Overall, the total bed capacity in commercial operations in the Wadden Sea region as a whole is recorded at more than 370,000 bed spaces, of which the German part accounts for about 52% with almost 193,000 beds followed by the Dutch Wadden Sea region accounting for 39% with almost 145,000 bed spaces. The Danish Wadden Sea region offers 34,200 bed spaces, accounting for less than 10% of the total bed capacity in commercial operations. However, the Danish bed capacity does not include the approximately 94,500 bed spaces available in about 13,700 holiday homes (with an average of 6.9 bed spaces) , which according to legislation, can only be rented in a maximum of 39 weeks per year.

Thus, holiday homes are the most common form of accommodation in the Danish Wadden Sea region with almost three times as many bed spaces as in other commercial accommodation like camping sites, hotels, and marinas.

About 14,300 holiday homes are recorded in the Dutch Wadden Sea region, corresponding to 98,700 bed spaces (with the same average number of bed spaces as in Denmark). Thus, the bed capacity of holiday homes in the Dutch Wadden Sea region is less than the bed capacity of about 145,000 in commercial operations.

Bed occupancy rates vary between 25-50% in the Wadden Sea Region. The German Wadden Sea region records an average annual occupancy rate of 35-37% while the Danish region records a rate of 25%. The Dutch region records average annual occupancy rates between 25-48% depending on the type of accommodation. The relative low occupancy rates indicate that the existing accommodation capacity in the different regions is not fully utilised.

3.2. Day Visitation

3.2.1. Denmark

Day visitors are not measured in Denmark and therefore, it is difficult to estimate the number of day visitors to the Danish Wadden Sea region.

However, in estimating the economic importance of tourism in the Danish Wadden Sea region (Destination Southwest Jutland), VisitDenmark on the basis of periodic sample surveys, estimate that the tourism revenue from day visitors and tourists overnighting in private accommodation in 2012 was DKK 668 million, constituting just below 15% of the total tourism revenue of DKK 4.6 billion during the same year.

3.2.2. Germany

Most recent studies on the number of day trips to the German Wadden Sea region from 2012 estimate that there were more than 45 million day trips to the coastal destinations of Lower Saxony and Schleswig-Holstein, generating a turnover of approximately EUR 1.3 billion.

Table 4. Number of day trips and revenue from day visitors in the German Wadden Sea Region in 2012.

3.2.3. The Netherlands

In the Dutch Wadden Sea region, day visitors are not measured. However, a tourism study undertaken in 2008 (Stichting Waddenfederatie) surveyed the proportion of day trips and short and long holidays in five of the islands. The island of Texel by far has the largest proportion of day trips with 51% followed by Ameland (21%) and Terschelling (17%) Vlieland and Schiermonnikoog are less popular for day visitors (10%).

Day visitors to the mainland of the Dutch Wadden Sea are mostly visiting specialised organised events such as the Delfsail, which in 20118 attracted more than 600,000 visitors to the harbour of Delfzijl. The tall ships races in Den Helder (2008) and Harlingen (2014) attracted in the levels of 350,000 and 200,000 visitors respectively. Every year, around 150,000 people visit the Visserijdagen in Harlingen. At the same time, smaller harbours are increasingly becoming focus points for Wadden Sea Excursions.

3.3. Tourism Revenue

3.3.1. Denmark

VisitDenmark estimates that tourism in the four municipalities in the Danish Wadden Sea region, in 2013 generated almost EUR 640 million against EUR 615 million in 2012.

Only the 2012 estimated revenue have been broken down on municipalities and by overnighting tourists in commercial accommodation establishments and tourists staying in non-commercial establishments and day visitors as shown in Table 5 below.

Table 5. Tourism revenue in the Danish Wadden Sea Region in 2012 by municipality, main market and type of accommodation (EUR million).

From the table, it can be seen that the revenue generated by overnighting tourists in commercial accommodation establishments corresponds to 73% of the total tourism revenue.

Since there were about 6.1 million overnight stays in commercial accommodation establishments in 2012, it can be calculated that the average expenditure per overnighting tourist was about EUR 75.

The dominating markets are Denmark and Germany, together accounting for more than 92% of the total tourism revenue in the Danish Wadden Sea region in 2012.

Tourists staying in rented holiday homes account for the largest proportion of the total tourism revenue in the Danish Wadden Sea region with more than EUR 270 million in 2012, corresponding to 44% .

The tourism revenue in the four Wadden Sea municipalities have a series of additional positive effects in the form of employment (see Section 3.4 below) and the regional GDP. Similarly, the tourism revenue result in both national and local government taxes. Thus, it is estimated that the tourism related taxation amounts to about EUR 255 million in 2012, of which EUR 45 million are municipality taxes.

3.3.2. Germany

Tourism revenues and data on the economic impact of tourism in the region are collected irregularly and on a basis of different sources. A direct comparison of figures over time or between the regions should therefore be undertaken with caution.

Most recent daily expenditure figures for tourists staying in commercial establishments show that Schleswig-Holstein destinations recorded a slightly higher average expenditure with about EUR 96 than Lower Saxony with EUR 87 (ref Table 6 below).

Table 6. Tourism revenue in the German Wadden Sea Region, 2010/2012 (EUR million).

Total tourism revenue in the German Wadden Sea region are estimated at almost EUR 3.9 billion, of which EUR 2.6 billion or 67% are generated by overnight tourists while day visitors generated almost EUR 1.3 billion, corresponding to about 33% of the total.

3.3.3. The Netherlands

Total tourism in the Dutch Wadden Sea region is generating an estimated EUR 2.2 billion, of which almost half is generated in Friesland, while Groningen generates EUR 613 million and the islands EUR 534 million. The data for the provinces also take the tourism revenues into account.

Table 7. Estimated tourism revenue in the Dutch Wadden Sea Region in 2012 (EUR million).

The average daily expenditure of tourists in the Dutch Wadden Sea region is not systematically measured. However, there are estimates of the daily expenditure of day visitors to Friesland and Groningen varying between EUR 40-50 between 2009 and 2015 (NBTC-NIPO, 2015).

3.3.4. Overall Wadden Sea Region

Overall, tourism revenue in the combined Wadden Sea region can be estimated at approximately EUR 6.7 billion, which is almost one billion Euro (973 million) higher than the estimated revenue stated in QSR 2009., corresponding to an increase of 17%. The German region accounts for more than 58% of the total tourism revenue with almost EUR 3.9 billion. The Dutch Wadden Sea region generate in the level of EUR 2.2 billion while EUR 615 million were generated in the Danish Wadden Sea region in 2012.

Table 8. Estimated tourism revenue in the Wadden Sea Region (EUR million).

As stated in the Section 1, the World Travel and Tourism Council (WTTC) estimates tourism’s total contribution to the national GDP at 6.9%, 8.9% and 5.6% for Denmark, Germany and the Netherlands respectively. In comparison, VisitDenmark estimates the tourism’s contribution to the GDP in the Danish Wadde Sea region at 4.6% (however, using a different methodology then the WTTC) – and varying greatly for the four local municipalities from 1.3% in Esbjerg to more than 30% in Fanø.

3.4. Tourism Related Employment

3.4.1. Denmark

It is estimated that tourism generates almost 5,100 jobs in the Danish Wadden Sea region as shown in Table 9. Especially in the small island municipality of Fanø, the importance of tourism is extraordinary with almost one third of the total employment being related to tourism. Also in Varde and Tønder municipalities are tourism important with some 8-9% of the total employment being tourism related.

Table 9. Tourism related employment in the Danish Wadden Sea Region in 2012 by municipality, main market and type of accommodation.

3.4.2. Germany

Most recent figures on employment in travel and tourism by the German employment agency show that 6.3% of total employment in the German Wadden Sea region is connected directly with tourism. The figures represent the share of employees under regular labour conditions (full or part time employment, full social security) in the tourism-, hotel or gastronomy sector.

Furthermore, there are indirect employment effects generated through tourism (e.g. in retail, construction, financial services, transportation, etc.), making the sector a main pillar of the labour market in the coastal areas of the region.

Table 10. Tourism related employment in the German Wadden Sea Region in 2014 by counties.

3.4.3. The Netherlands

The tourism related employment in the Dutch Wadden Sea region is estimated at almost 40,000 full-time jobs (38,300) as presented in Table 11 below. The mainland of Friesland records almost 19,000 full-time tourism related jobs while about 15,300 are employed in tourism in Groningen. Of the total number of jobs on the Dutch islands, 25% is related to tourism (Sijtsma et al., 2014).

Table 11. Tourism related employment in the Dutch Wadden Sea Region.

3.4.4. Overall Wadden Sea Region

As shown in Table 12 below, tourism generates about 58,000 full-time jobs in the entire Wadden Sea Region, corresponding to 6.3% of the Region’s total employment. Of the total of number of full-time tourism related jobs, 38,300 jobs are generated in the Dutch Wadden Sea region, accounting for 66% of the overall total tourism related jobs. The German region accounts for 25% with 14,600 full-time jobs while the Danish Wadden Sea region accounts for about 9%.

Table 12. Estimated tourism related employment in the Wadden Sea Region).

4. Monitoring of main tourism activities

An overview of land-based tourism indicates the general trends of Wadden Sea tourism and its economic importance. In order to have a holistic view how tourism activities shape a region, it is necessary to observe the trends and identify the impacts of tourism activities in the Wadden Sea regions. In addition, the results of two specific TMAP monitoring parameters: Boats at Sea and Guided Tours, are presented. These two parameters give an indication of the level of the recreational activity and, over years, an impression of the trend. They are also indicative of the potential or actual level of disturbance, for example, of birds and seals.

Over the years, these activities have been monitored very differently, both between the three countries and within each individual Wadden Sea regions.

4.1. Tidal Flat Walking

Denmark

There are no ongoing monitoring mechanisms in place in the Danish Wadden Sea region, and no monitoring has taken place since the QSR 2009. No TMAP data were reported.

Germany

Tidal flat walking is one of the most popular attractions in Germany, directly related to the Wadden Sea. Many destinations offer guided tours, carried out by several nature NGOs, certified National Park guides and National Park rangers. In Schleswig-Holstein, there are complete statistics over time, which give an impression on the high long-term interest in this nature-related activity.

Figure 3. Guided tidal flat walking tours in the Schleswig-Holstein Wadden Sea Region, 1999-2014 (add 2015).

Although tidal flat walking is a very popular and important tourist activity in Lower Saxony too, there is no regular monitoring established to count or estimate the number of tours and participants.

Another source of information on guided tidal flat walking tours is a visitor survey undertaken in 2013 under the PROWAD project. The visitors were asked whether had already participated in such a tour (Experience), are interested to do so (Interest) or don´t want to take such a tour (Refuse) (ref. Table 13).

Table 13. Guided Tidal Flat Walking in the German Wadden Sea Region in 2013 by counties.

The Netherlands

In the Dutch Wadden Sea region, the majority of guided walking tours are organised by specialised organisations in Groningen and Friesland. For safety reasons, and to minimize the environmental impact by this type of activity, the government has set a limit to the number of annual participants at 50,500.

From 1996-2010, the number of participants was published annually as shown in Figure 4 below.

Figure 4. Number of participants in Guided tidal flat walking tours in the Dutch Wadden Sea Region (specified for seven organisations), 1996-2010.

The figure shows a downward trend from 34,000 participants in 1999 to less than 22,000 in 2010. After 2010, monitoring results are no longer published.

In 2015, about 25,000 participants were recorded taking part in 34 different types of guided tours, considerably less than the 34,000 participants in 1999. The number of people taking part in nature excursions on the tidal flats is not taken into account as these data are lacking.

4.2. Recreational Boating

Denmark

There are no ongoing monitoring mechanisms in place in the Danish Wadden Sea region, and no monitoring has taken place since the QSR 2009. No TMAP data were reported.

Germany

There are no ongoing monitoring mechanisms in place on recreational boating in the German Wadden Sea region, and no monitoring has taken place since the QSR 2009.

In Schleswig-Holstein, 963 berths for leisure boats were counted in 2013 (344 in North Frisia and 619 in Dithmarschen).

Wind surfing and kite surfing are also waterborne sport activities that are carried out in certain parts of the German Wadden Sea, mainly at places with a high number of tourists such as Sylt, St. Peter-Ording and Cuxhaven. Unfortunately, there are no public market data on this trendy sport activity available.

The Netherlands

The Wadden Sea coast of the Netherlands can only be reached form the open sea or through eight sluice passages. The number of sluice passages has been recorded since 1982 and is an important parameter to monitor recreational boating in the Dutch Wadden Sea region.

The numbers of sluice passages has increased from about 100,000 in 1996 to more than 120,000 in 2006, but has since then decreased to about 90,000 in 2015 as shown in Figure 5 below.

Figure 5. The number of sluice passages in the Dutch Wadden Sea, 1996-2015. Source: Rijkswaterstaat Marjan Vroom, 2016.

The number of sluice passages is highest from June – October with peaks in July and August with more than 20,000 passages per month while there are hardly any passages during the winter months as shown in Figure 6 below.

Figure 6. Seasonality of sluice passages in the Dutch Wadden Sea, 2010-2015. Source: Rijkswaterstaat, Marjan Vroom, 2016.

4.4. Conclusion on Monitoring Measures

The number of guided tidal flat walking tours is an indicator on how many visitors experience the property. In Schleswig-Holstein, the number of guided tours as well as the number of participants (1999 – 2014) shows no clear trends and varies around 5,000 tours and 115,000 participants annually (around 20 – 25 persons per tour). In the Netherlands, a limit has been set at 50,500 annual participants. Since 2006, the number of participants was recorded around 25,000 per year, which is less than the years before (up to 32,000). Recreational boating in the Netherlands (recorded as the number of sluice passages during 1996-2015) has also decreased since 2009 from around 120,000 to around 90,000 in the last years.

It is evident from the above, that there are no compatible monitoring measurements of tourism activities in place for the entire Wadden Sea Region. But long-term monitoring and assessment are necessary in relation to the impacts of tourism on biodiversity and the environment. Therefore, it is recommended that the three countries identify which monitoring means can be put in place in all three countries as part of the TMAP with a view to ensuring appropriate and compatible monitoring of tourism activities in the entire Wadden Sea region.

5. Tourism Development in Wadden Sea

This section presents the development in tourism in the Wadden Sea Region since the QSR 2004 and 2009. However, the comparison of data has been challenging due to changes in methods of measurement as well as in administrative areas of measurement. Therefore, some figures have been estimated, in order to give an indication about the overall size or range (see remarks in the tables)

For the first time since the inscription of the Wadden Sea on the WH List, the QSR 2016 has compiled and assessed tourism date for the entire Wadden Sea World Heritage Destination, as defined in the tourism strategy, which covers the property itself and adjacent areas outside the property on the islands and on the mainland, as defined as the Wadden Sea Region (=Wadden Sea World Heritage Destination). Table 14 below gives an overview of the development in the basic tourism data for the Wadden Sea region in the three countries combined since QSR 2004 and 2009.

5.1. Volume of tourism in the Wadden Sea Region

More than nine million visitor arrivals are recorded in the Wadden Sea Region, generating more than 53 million overnight stays. At the same time, sporadic information about the number of day visitors indicates that the region generates some 40-60 million day visits.

Due to the different data sources in the three countries, and changes in statistical methods, an overall trend cannot be identified. However, compared to the results of the QSR 2009, a slight increase can be seen in some regions (e.g. Lower Saxony and the Netherlands), whereas other regions showed stagnation, or even a decrease in numbers (e.g. Denmark)

5.2. Economic impact of tourism in the Wadden Sea Region

The economic importance of tourism for the overall Wadden Sea region and the three individual regions has steadily increased since the QSR 2004 and QSR 2009. Thus, the total revenue generated from tourism in the Wadden Sea region increased from EUR 5.7 billion estimated in QSR 2009 to EUR 6.7 billion estimated in QSR 2016. This corresponds to an increase of about 17%.

While the economic impact of tourism in the overall Wadden Sea Region is generally greater than the national averages for the three Wadden Sea countries, it is particularly pronounced in some of the local areas like the island municipality of Fanø, in Denmark where Tourism is estimated to contribute about 30% to the total municipality GDP.

At the same time, tourism in the Wadden Sea Region is estimated to generate about 58,000 full-time jobs, corresponding to 6.3% of the Region’s total employment. Of this, the Netherlands Wadden Sea region accounts for about 66%, while the German region accounts for 25% and the Danish region for about 9%.

Table 14. Overview of tourism related parameters available for QSR 2004, 2009.

5.3. National developments

5.3.1. Denmark

Denmark in general and the Danish Wadden Sea region in particular has experienced record years in the volume and value of tourism in 2014 and 2015, where 6.5 million overnight stays were recorded in the four Wadden Sea municipalities. This is more 9% more than the 5.9 million in 2013. However, the increase in tourism comes after years of status-quo in the volume of tourism, with marked decreases in the number of overnight stays by foreign tourists, and especially German tourists.

The total number of overnight stays in the Danish Wadden Sea region was reported at 6.6 million in the QSR 2009 for 2007, the year of the changes in administrative areas of measurement, and therefore, not directly comparable. Thus, for instance, Denmark had a municipality reform in 2007, which reduced the number of regional and local municipalities through merger, resulting in great difficulties in comparing data before and after the reform. This was also noted in the QSR 2009 tourism section.

While the QSR 2009 does not provide details of the accommodation capacity in the Danish Wadden Sea region, this is currently recorded at about 34,200 bed spaces in commercial establishments other than holiday homes, which number 13,700. As legislation limits the number of weeks that holiday homes can be rented to 39 weeks per year, the total available house-weeks is estimated at about 534,000 weeks. Of these, about 134,000 weeks were recorded sold, corresponding to a capacity utilization of 25.1%.

Tourism related employment in the Danish Wadden Sea region was in QSR 2009 recorded at 3,500 full-time jobs in 2007, having increased to 5,100 full-time jobs in 2012. This corresponds to an increase of almost 46% or an average annual increase of 7.8%.

QSR 2009 recorded the tourism revenue from overnight tourism in the Danish Wadden Sea region at EUR 358 million in the year 2007. This has increased considerably to EUR 545 million in 2013, corresponding to an increase of more than 50% or an average annual increase of 7.3%.

While QSR 2009 did not record the tourism revenue from day visitors, this is recently estimated at 15% of the overall total tourism revenue in the Danish Wadden Sea region, corresponding to EUR 95 million. This brings the total tourism revenue in the area to EUR 640 million – almost the doble amount that was recorded in QSR 2009.

5.3.2. Germany

The Wadden Sea region is a major and long-time popular holiday destination in Germany. Facts from the “Reiseanalyse”, the most extensive travel behaviour study in Germany, underline the popularity of the destination: In 2014, more than 2.8 million trips to the Wadden Sea region, lasting 5 days or more, were recorded and about 5.8 million people were interested in a trip to the region in the next 3 years. Both figures were on the same level in the years before.

Compared to the results of QSR 2009, the number of day visitors to the region is stable on a high level.

5.3.3. The Netherlands

The Dutch Wadden Sea islands have developed into a very popular holiday destination. Over half of all Dutch people have visited at least one of the islands, mostly on family holidays, and the proportion of repeat visits is high. The number of nights spent on the islands by Dutch tourists during the period 2009-2014 remained almost constant. According to the Dutch Central Bureau of Statistics, 7% of the long, and 4% of the short Dutch domestic holidays are spent on the Dutch islands. This number is fairly constant from 2002 until 2014.

At the same time, the number of nights spent by German visitors has decreased drastically by 40% since year 2000 according to Sijtsma et all (2012), i.e. from around 1.7 million nights in year 2000 to 1.0 million in 2009, although the islands of Texel and Ameland still receive a large number of German visitors. One of the reasons for this situation could be the development of tourism in the competing coastal area of the former East Germany. Due to the decline in German visitors to the Dutch Wadden Sea islands, the share of foreign tourists of the total number of tourist nights has also decreased from 30% at beginning of this century to 17% in 2015. According to a survey among potential visitors in Germany and Belgium the island Texel is the most popular (19% of the Germans; 15% of the Belgians), followed by Ameland (10%; 5%) and the other islands (5%) (NBTC-Holland Marketing, 2016).

After a peak in 2006, pleasure boating in the Dutch Wadden Sea showed a downward trend and is now at the same level as in 1996. Also the number of participants of guided tidal flat walking tours has decreased sharply during the last decade. It stabilised around 25,000 participants in 2015, far below the maximum capacity of 50,500.

6. The Effects of World Heritage Inscription on Tourism in the Region

In general the World Heritage status of natural areas can contribute to sustainable development in many ways. World Heritage Sites can be important for economic development, by attracting new investments and generating locally-based, environmentally-friendly employment (Boccardi and Duvelle, 2013). The status can generate jobs in outdoor recreation and tourism, but also in the preservation of natural heritage. In addition, the preservation of World Heritage sites facilitates spiritual well-being of local people and visitors, through the strong symbolic and aesthetic dimensions of the natural landscape. The possibility to access and enjoy one’s own heritage is therefore an important issue, enabling feelings of attachment and belonging to the place. These insights are currently being integrated into the processes of the World Heritage Convention.

In this connection, UNESCO defines sustainable tourism as “tourism that respects both local people and the traveller, cultural heritage and the environment”. With the World Heritage Inscription, a new chapter for tourism in the Wadden Sea Region has started. Following the request of the World Heritage Committee, the trilateral Task Group Sustainable Tourism Strategy consisting of tourism and nature conservation stakeholders developed a Sustainable Tourism Strategy for the Wadden Sea Region. The Strategy provides a long-term framework for tourism development in the region. A common perspective is formulated in a vision statement and broken down in four strategic objectives:

- To ensure all stakeholders have a transnational understanding and appreciation of the values of the Wadden Sea World Heritage property.

- To ensure stakeholders have responsibility for and contribute to the protection of the ‘Outstanding Universal Value’ through involvement in tourism management and product development.

- To ensure the tourism sector provides consistent communication and marketing, and promotes the high quality tourism offers of the Wadden Sea World Heritage Destination.

- To ensure nature conservation, tourism and local communities benefit from the World Heritage Status.

This strategy offers the chance to use the high demand on nature based tourism and nature experience for the economic benefit of the region without endangering its outstanding ecological value.

6.1. Denmark

Nature based tourism is growing globally as well as in Denmark. Recent research of travel motivations for tourists in Denmark shows that nature is the main reason for tourists to choose Denmark as a destination (VisitDenmark, 2016). The Waddensea Nationalpark Denmark (Nationalpark Vadehavet) is located in the four municipalities of Varde, Esbjerg, Fanø and Tønder, where more than 6 million tourist bed nights are spent annually, in fact the second biggest tourist destination in Denmark after Copenhagen. According to analyses undertaken by the Danish Coast and Nature Tourism, most of the tourists come because of nature, especially the West coast with the broadest sandy beaches in Europe as well as for the Wadden Sea.

The Waddensea Nationalpark Denmark was established in 2010 and a branding analysis on 5 markets showed that in 2014, almost one third of all Germans knew about the national park (VisitDenmark, 2015). This is perhaps because the German national parks in the Wadden Sea carry the same name. However, it still indicates a great awareness and provides a potential for many visitors in the future.

In autumn 2015, the national park partners were asked (150+ SMEs, museums, nature centres and others), about the reasons for their guests to come to the Danish Wadden Sea region by Waddensea Nationalpark Denmark. While the unpublished analysis is only indicative and not statistically valid, it reveals that 30% of all guests come because of the national park and most of these guests will with or without nature guides visit the Wadden area.

The analysis and qualitative interviews furthermore indicate that more and more tourists are interested in visiting the Wadden Sea because of the area’s status as a World Heritage site. Traditionally, 90% of the tourists are Danish and German and the rest from Norway, Sweden and the Netherlands, but nature guides from the area report that there is a tendency that more tourists are coming from Southern and Central Europe as well as from the UK and a few from others markets. This is a new tendency and due to the establishment of the national park and the World Heritage status. Still, the trend is new and the coming years will show, if the trend will continue.

6.2. Germany

Already before the inscription of the Wadden See as a World Heritage Site, and more intensive thereafter, the tourism marketing at the German North Sea coast took up this issue and communicated the new status towards their customers. Therefore, the World Heritage Status is now a visible part of the tourism product of the region.

Table 15. Importance of the World Heritage Inscription for the travel decision in the German Wadden Sea Region.

In Schleswig-Holstein, a PROWAD guest survey in 2013 (ref. Table 15) revealed an increase of the importance of World Heritage for the travel decision from 10% in 2011 to about 20% in 2013. The committed address of the World Heritage Status in the tourism marketing of the region is possibly reflected in the higher interest of visitors in World Heritage.

Thus, the interest in the Wadden Sea Word Heritage and how to experience the Outstanding Universal Value (OUV) has increased amongst visitors since the inscription in 2009 (PROWAD , 2013 Visitor survey in the German Wadden Sea ). Almost every visitor to the German Wadden Sea is aware about its status as World Heritage site. For about 33% of the visitors, World Heritage is an important factor in deciding to visit the region, and for almost half of the visitors, protection of the Wadden Sea as a national park is important for the travel decision. A pristine nature and nature conservation at the holiday destination is an important aspect for over 90% of the visitors which document the enormous potential that tourism can play to protect and maintain the OUV and contributing to the World Heritage Convention.

6.3. The Netherlands

Whether the designation of the Wadden Sea as a World Heritage site has influenced tourism development in the Dutch Wadden Sea region is not easy to assess. Sijtsma et al. (2012) doubt the immediate added value of the UNESCO status for tourism when looking at the distribution of tourists. Based on the results of their hotspotmonitor, a survey among members of the Dutch nature conservancy organization Natuurmonumenten, they conclude that visitors to the Dutch Wadden Sea area appreciate the Wadden Sea islands the most. Especially the beaches, dune areas and forests are favourite hotspots The natural values of the Wadden Sea itself are of minor importance for their stay in the region.

Revier (2013) reports on different surveys about the effect on tourism of the World Heritage status of the Wadden Sea. Visitors to the harbour city Harlingen in the Netherlands were asked about their knowledge and expectations of the World Heritage nomination of the Wadden Sea. Also stakeholders in the Dutch and German Wadden Sea regions (representatives of the municipalities, restaurant-owners, entrepreneurs, etc.) were questioned. The main results of these surveys indicate that awareness about the World Heritage status has grown substantially (30% in 2008, 74% in 2009 and 75% in 2014). But only for a small majority (around 50% of the passengers of the ferries to Vlieland and Terschelling), the World Heritage status is a real reason to visit the area. Due to the nomination, stakeholders in the tourism industry expected an increase of tourism and a positive added value to the image of the Wadden Sea. However, it appears that the tourism industry and local authorities have not made fully use of marketing opportunities to achieve this (Revier, 2013). These findings confirm the assumption that an inscription of the Wadden Sea on the World Heritage List will not automatically result in an overall increase of visitor numbers, also because the North Sea is already a strong tourism destination. Similar observations were reported from other, already well developed World Heritage sites (e.g. Rebanks 2010)

Also, research on the island of Terschelling in 2014 showed that for most respondents (93.5%) the World Heritage Status was not a reason to visit Terschelling, while almost a quarter (23.7%) did not know about the World Heritage Status. However, the Wadden Sea was regarded as one of the most attractive elements of the area, together with the North Sea beach, dunes and forests of the island of Terschelling. For 58% of the respondents, the Wadden Sea was a reason to visit.

While the Wadden Sea is generally highly appreciated, the designation as World Heritage Site is not a reason for visiting the region for domestic tourists. First-time visitors or international tourists, who are more likely to be attracted by the World Heritage status, were not found during the autumn holidayson the island Terschelling in 2015. More efforts could be made to promote the Wadden Sea region as an attractive natural area among these groups of tourists, in order to gain more support for nature protection and preservation of this unique natural heritage (Folmer et all, 2016).

6.4. Conclusion

From the above, it is evident that the World Heritage status of the Wadden Sea has the potential for affecting tourism development in the Wadden Sea Region positively in respect of increasing numbers of visitors and increasing tourism revenue, which need to be documented through future surveys.

Similarly, the awareness about the World Heritage status both among tourism stakeholders and visitors has increased extensively since the QSR 2009, i.e. prior to the inscription of the Wadden Sea as a World Heritage site.

These findings also confirm the assumption that an inscription of the Wadden Sea on the World Heritage List does not automatically result in an increase of visitor numbers without additional marketing efforts, also because the North Sea is already a strong tourism destination. Similar observations were reported from other, already well developed World Heritage sites (e.g. Rebanks 2010).

There is no doubt that the World Heritage status can be even further exploited in the development and marketing of tourism in the Wadden Sea region through focused use of the heritage brand in the marketing and promotion of tourism, and through the engagement of the tourism sector and visitors in the protection of its Outstanding Universal Value of the Wadden Sea.

To give a sustainable boost to the Wadden Sea region as a tourism destination, the UNESCO status has to be regarded as an interesting and challenging opportunity for the region. (see Rebanks 2010: World Heritage as a catalyst: 12 impact areas).

It requires a clear and focused vision and strategy, and an increased awareness of the values that qualify the Wadden Sea as a natural World Heritage site as a first step. The strategy on “Sustainable Tourism in the Wadden Sea World Heritage” has laid the foundation. Only the implementation of this strategy will ensure that tourism development and nature conservation will mutually benefit. Raising awareness about the natural values of the Wadden Sea, also among tourism stakeholders, may also contribute towards increasing the number of visitors to the region and contribute to an emotional attachment to the protected area and public support for the conservation programmes. Further research should aim on explaining differences in the perception of the Wadden Sea by different visitor target groups and on exploring ways to attract new visitor groups to the area without affecting the Outstanding Universal Value of the region.

7. Recommendations

This section includes recommendations for the improvement of the collection and dissemination of tourism statistics information in the Wadden Sea region. Overall, the recommendations aim at:

- Standardising methodologies for collecting tourism related information in the three Wadden Sea countries

- Provide more detailed information about the benefits and other impacts of tourism in the Wadden Sea countries for the benefits of both the Wadden Sea tourism and conservation stakeholders and visitors.

The authors’ team may expand on the list of recommendations during the review of this draft version of the QSR 2016 Tourism and Recreation chapter.

- Integrate in the existing research being undertaken in the region the conduct of regular transnational visitor surveys, covering the entire Wadden Sea, where visitors are questioned about the importance of the World Heritage status and the Wadden Sea in general for the visitor experience. The visitor survey does not need to be conducted every year, since the travel patterns do not change rapidly. Therefore, the surveys could be conducted every 3rd or 4th year.

- Conduct of regular cross-national surveys of the local tourism industry and the local population where tourism related SMEs and the local population are questioned about their awareness about and pride in the World Heritage status and the Wadden Sea in general as well as the potential utilisation of these aspects in their marketing and promotion. The survey is recommended to be conducted every 3rd-4th year.

- Conduct of systematic cross national visitor expenditure surveys where both day visitors and overnight tourists are questioned about their expenditure patterns while visiting the Wadden Sea region. The surveys should be undertaken regularly every 3rd year and may be undertaken as separate surveys or as part of the above proposed visitor survey investigating the importance of the World Heritage status.

- Implementation of a joint cross national initiative between educational centres and student research to ensure that the same aspects and issues are investigated across borders to enable easy comparison of the research and its use in future QSRs – as well as by those who really use the data.

- While tourism in the Wadden Sea Region is already of great importance for the regional and local economies, there is a need to ensure that tourism activities respect the environmental and conservation requirements to retain the Wadden Sea’s rich ecological value and biodiversity and its Outstanding Universal Value (as outlined in the tourism strategy) . This report indicates that there is a need to revisit which tourism activities to monitor, and how to assess their respective impacts, and the methodologies of monitoring, e.g. as part of the Trilateral Monitoring and Assessment Programme (TMAP). The social-economic monitoring in the Wadden Sea of Schleswig-Holstein (SÖM) might serve as an example how this can be done in a comparable (coherent) manner in the entire Wadden Sea World Heritage site. In this connection, measuring the marina capacity could also be considered.

Annex 1. Detailed Regional Statistics Tabulations

This annex presents detailed statistical tabulations for the individual Wadden Sea regions.

A.1.1. Denmark

Table A1.1 below shows the capacity and the capacity utilization of holiday homes in the Danish Wadden Sea region for the year 2013, where the number of rented house-weeks were recorded at almost 134,000, corresponding to a capacity utilization of about 25% for the area as a whole, which is high compared to the national average of 6.1%.

Table A1.1. Renting of holiday homes in the Danish Wadden Sea region in 2013 by municipality.

In comparison, Table A1.2 shows the capacity of other accommodation facilities than holiday homes in the Danish Wadden Sea region in the period 2010-2013 by type of accommodation. The table shows that in addition to the approximately 13,700 holiday homes, there are some 76 commercial accommodation establishments in the area with a combined capacity of 34,154, having increased slightly from about 33,000 in 2010.

Table A1.2. The capacity of accommodation facilities in the Danish Wadden Sea region in the period 2010-2013 by type of accommodation and excluding holiday homes.

As can be seen in Table A1.3 below, overnight stays in rented holiday homes comprise almost two thirds of all commercial overnights in the Danish Wadden sea with about 4.2 million of the total of 6.5 million. Second most popular type of accommodation is camping, accounting for 1.3 million overnights or 20.6% of the total.

Table A1.3. Total number of overnights stays in the Danish Wadden Sea region in the period 2013-2015 by type of accommodation (Statistics Denmark, VisitDenmark and own estimates).

In the Danish Wadden Sea region, hotel overnights only comprise 5% of the total number of overnights with about 323,000 overnights.

Table A1.4 below presents the total overnights stays in the Danish Wadden Sea region by municipality with Varde Municipality accounting for more than half (56.3%) of the total number of overnights with more than 3.3 million out of the total 6.5 million. Tønder Municipality is accounting for 22.5% or 1.3 million.

Table A1.4. Total number of overnights stays in the Danish Wadden Sea region in the period 2010-2013 by municipality.

As can be seen from Table A1.5 below, foreign tourists account for the majority of overnights stays in the Danish Wadden Sea region with almost 4.1 million overnights in 2013, corresponding to more than 68% of the total overnights of just below 6 million. German tourists account for almost 3.7 million overnights, corresponding to 62% of the total. In Fanø Municipality, German tourists accounted for as much as 77% of the total overnights in 2013.

Danish (domestic) tourists recorded slightly less than 1.9 million overnights in the total Danish Wadden Sea region, accounting for 31.5% of the total overnights in 2013. Within the individual Wadden Sea municipalities, Danish tourists accounted for only 20% of the total number of overnights in 2013 in Fanø, 27% in Varde and 35% in Tønder Municipality.

Esbjerg Municipality is atypical as an urban municipality, where Danish tourists account for more than two thirds of the overnights. Similarly, in Esbjerg German tourists only account for 10% of the total overnights in 2013. Esbjerg Municipality is also characteristic in being the only municipality attracting UK tourists, perhaps as a result of the oil/gas and offshore connections to the UK.

Table A1.5. Number of overnight stays in the Danish Wadden Sea region in 2013 by market area and municipality.

In respect of overnight stays, other important markets for the Danish Wadden Sea region are Holland with about 121,000 overnights in 2013, Norway with about 83,000 and Sweden with some 50,000 overnights.

VisitDenmark estimates that tourism in the four municipalities of Destination South West Jutland, corresponding to the Danish Wadden Sea region, in 2013 generated almost EUR 640 million as shown in Table A1.6 below.

The dominating markets are Denmark and Germany, together accounting for more than 92% of the total tourism revenue in 2012 in the Danish Wadden Sea region. The two markets are approximately identical, measured in total tourism revenue.

Table A1.6. Tourism revenue in the Danish Wadden Sea region in 2012 by municipality, main market and type of accommodation (EUR million).

A.1.2.The Netherlands

The total bed capacity in the Dutch Wadden Sea islands amount to approximately 98,250 with Texel accounting for the majority of about 44,000 beds, of which most are to be found in holiday homes (about 12.600) and camp sites (10.750 spaces). The total bed capacity on Texel is approaching the agreed maximum of 47,000 beds (Ecomare, 2015). Terschelling and Ameland each offers some 20,500 bed spaces, again with the majority in holiday homes and camp sites.

Table A1.7. The total bed capacity on the Dutch Wadden Sea islands.

On the mainland of the Dutch Wadden Sea region, the total bed capacity in Friesland and Groningen is estimated at about 90,000 and 15,500 respectively as can be seen in Table A1.8.

Marinas account for more than one third of the total bed capacity in Friesland with about 33,000 bed spaces while camping sites offer some 26,000 bed spaces. There are about 12,000 bed spaces in group accommodation while hotels and pensions offer a total of about 9,000 bed spaces in Friesland.

In 2015, the total bed capacity (including marinas) has increased to about 138,100 in Friesland and about 29,200 in Groningen (CBS, 2016).

Table A1.8. The total bed capacity on the Dutch mainland Wadden Sea by type of accommodation, 2009-2012.

In 2015, the total bed capacity has increased to about 138,100 in Friesland and about 29,200 in Groningen (CBS, 2016).

The Dutch Wadden Sea region records about 4.4 million visitor arrivals. The Wadden Sea islands account for almost 57% with about 2.5 million arrivals, while Friesland and Groningen record about 1.3 million and 600,000 arrivals respectively.

The island of Texel records the highest number of arrivals of all the Dutch Wadden Sea islands with almost 900,000 of the total of about 2.5 million island arrivals.#

Table A1.9. The current volume of tourism in the Dutch Wadden Sea region.

The occupancy rate of the different type of accommodations on the Wadden Sea islands has been clustered and can therefore not be presented by island. Furthermore, Texel is not included in the percentages. However, it can be stated that occupancy rates are highest on campsites with 95% and marinas with about 87%.

Table A1.10. Average annual occupancy rate on the Dutch Wadden Sea islands by type of accommodation, 2006-2010.

The average annual occupancy rates in Groningen are highest for heritage lodging with about 40% (2010) closely followed by hotels and pensions with 38.4% in 2012. In Friesland, hotels and pensions record approximately the same occupancy rate as in Groningen with just over 37%. Holiday homes in Friesland record average annual occupancy rates of about 33% against 30% in Groningen.

Table A1.11. Average annual occupancy rate in the Dutch Wadden Sea regions of Friesland and Groningen by type of accommodation, 2010-2012.

There is no systematic measuring of foreign visitors in the Dutch Wadden Sea region. However, some estimates are made for the Wadden Sea islands. Thus, it is estimated that about 62% of the tourists to the island of Texel are domestic Dutch visitors, while about one third are Germans with other countries only constituting 4%. Similarly, 805 of the visitors to the island of Terschelling are Dutch while about 30% of the visitors to Ameland are Germans.